Filing your Income Tax Return (ITR) is something every salaried person in India must do every year. But for many, the process feels confusing or stressful. The good news is that in 2025, filing ITR online has become easier than ever.

This article will explain everything you need to know— from documents needed to the step-by-step process. Whether it’s your first time or you want a quick refresh, this guide is for you.

Why Is Filing ITR Important?

Filing ITR (Income Tax Return) is not just about paying tax. It is a proof of your income and financial honesty. Here’s why it matters:

- Required when applying for loans or visas

- Helps claim tax refunds

- Keeps your income records clear

- Mandatory under law if your income is taxable

Even if your income is below the taxable limit, filing ITR shows financial responsibility.

Who Should File ITR?

You must file ITR if:

- Your income is above ₹2.5 lakh per year (for those below 60 years)

- You want to claim a refund on TDS (Tax Deducted at Source)

- You have foreign assets or income

- You want to carry forward losses (e.g., stock losses)

Documents Required for ITR Filing (2025)

Before you start, keep these documents ready:

| Document | Purpose |

|---|---|

| PAN Card | To identify you as a taxpayer |

| Aadhaar Card | Mandatory for verification |

| Form 16 | Issued by your employer; shows salary + TDS |

| Salary Slips | For income proof (if Form 16 not available) |

| Bank Account Details | For refund credit |

| Investment Proofs (if any) | To claim deductions under 80C, 80D, etc. |

| Home Loan / Education Loan Docs | If you want tax benefits on interest |

| Form 26AS / AIS | For tax credit & income summary |

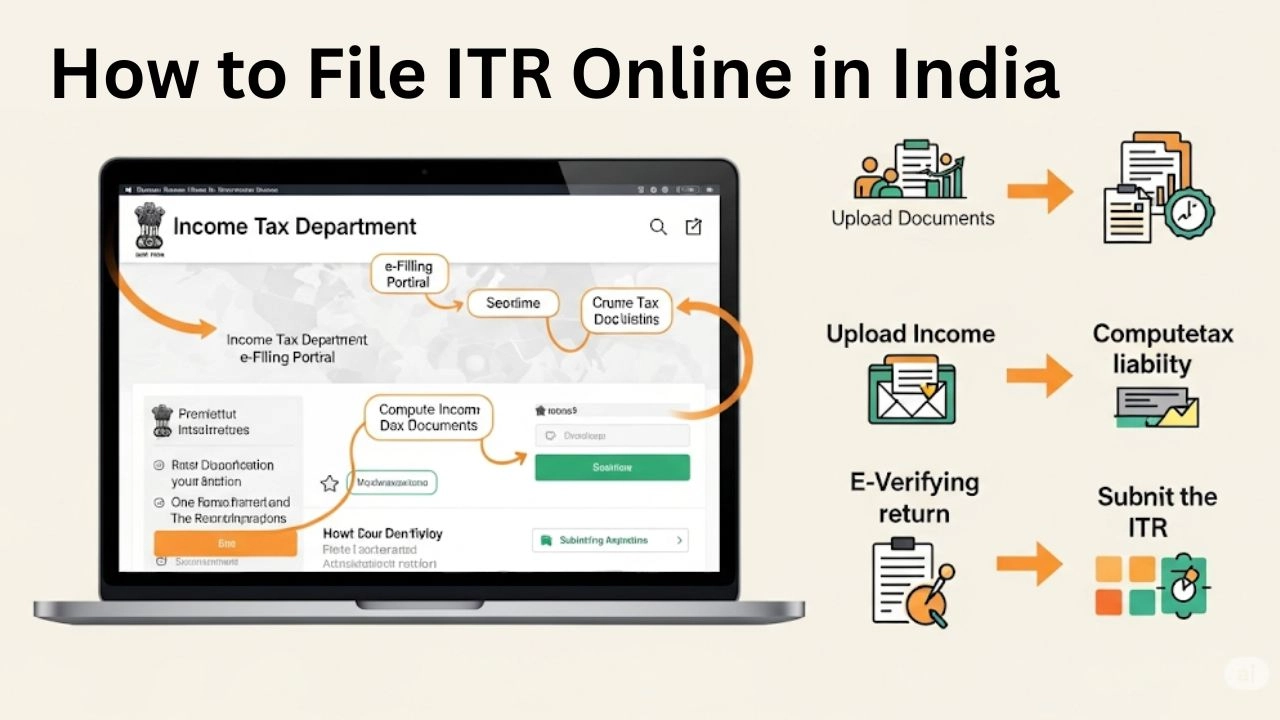

How to File ITR Online in 2025 – Step-by-Step Process

Step 1: Visit the Income Tax Portal

Go to https://www.incometax.gov.in

Step 2: Log in Using PAN

If you don’t have an account, register using your PAN and mobile number.

Step 3: Choose “File Income Tax Return”

Select the assessment year as 2025–26 and choose online mode.

Step 4: Select ITR Form

For salaried individuals, ITR-1 (Sahaj) is usually the correct form.

Step 5: Pre-Fill and Verify Data

The portal will automatically fill your salary, TDS, and interest data from Form 26AS. Verify it carefully.

Step 6: Add Deductions

Add eligible deductions under sections like 80C (investments), 80D (health insurance), etc.

Step 7: Review Tax Summary

Check if you need to pay more tax or if you’re getting a refund.

Step 8: Submit and Verify

Submit the return and verify it through Aadhaar OTP, net banking, or DSC (Digital Signature Certificate).

You’ll get an acknowledgment via email and SMS.

Real-Life Example

Let’s take Anjali, a 28-year-old software developer from Noida. She earns ₹8.5 lakh per year. Her employer deducts TDS, and she also invests ₹1.5 lakh in ELSS funds.

When she logged in to the portal, most details were already filled. She just added her ELSS investment, verified everything, and filed ITR within 20 minutes — without any CA help.

Like Anjali, you can file your ITR confidently from your phone or laptop.

Common Mistakes to Avoid

- Not verifying Form 26AS or AIS data

- Missing deductions under 80C or 80D

- Filing incorrect ITR form

- Not verifying the return after submission

- Giving wrong bank account details for refund

Double-check everything before submitting.

FAQs

Q1. Is it mandatory to file ITR if I have only one salary income?

Yes, if your total income crosses the basic exemption limit (₹2.5 lakh).

Q2. What is the last date to file ITR for AY 2025–26?

The due date is 31st July 2025 (unless extended).

Q3. Can I file ITR without Form 16?

Yes, but you must calculate your income and TDS manually using salary slips and Form 26AS.

Q4. Can I revise my ITR after submission?

Yes, revised returns can be filed until 31st December 2025 (subject to rules).

Q5. Is it safe to file ITR without a CA?

Absolutely. The new portal is user-friendly, and most salaried people can do it on their own.

Final words

Filing your ITR doesn’t need to be scary or technical. With the new system in place, it’s easier than ever. All you need is a little preparation, internet access, and 20–30 minutes.

Don’t wait till the last minute. File your return early and stress-free. It’s not just a duty — it’s a smart financial move.

Leave a Reply